You may be wondering why the RRSP contribution deadline is such a big deal. While the registered retirement savings plan is mainly an investment for your retirement, your contributions can also be of benefit to you now. While there is typically no RRSP contribution minimum, missing the deadline does have other consequences.

The Canada Revenue Agency sets an RRSP Contribution limit each year. So, even if you wanted to contribute more to make up for the last deadline, you may not be able to. While the RRSP deadline is not something to panic over, it is important as a personal investment. We take a look at everything you need to know to make the most of your Registered Retirement Savings Plan.

What is an RRSP?

An RRSP is a registered retirement savings plan offered in Canada (look here for the best offers). The investment is tax-deferred, which means you do not pay taxes until you withdraw the contributions (also, if you have unused contribution room you can take an RRSP loan, as explained here). When you withdraw the funds during retirement, the funds are subject to income tax (to learn more, see our earlier ‘Best Way to Withdraw Money From RRSP’ article). RRSPs are great investments since you will likely pay less tax at a lower income bracket when you retire.

When you contribute to your RRSP, you also get a tax deduction for that specific tax year ( see our withholding tax guide). The 60 days after the year ends will help you determine a proper amount for your RRSP contribution. If you have a high liability for the tax year, you may want to make sure not to miss the RRSP contribution deadline this tax year. There are also a number of different investment options in an RRSP including:

Mutual Funds

Mutual funds are a collection of investments including stocks and bonds. Investment companies or managers typically manage mutual funds for investors. They pool funds into stocks and investments. Professionals handle your investments, which means you will have to pay a management fee. This amount is typically around 2% of the investment funds. This is a riskier investment, but some find that there are higher returns.

GICs

GICs stand for guaranteed investment contracts. They are essentially a type of savings contract between an investor and a company. This option is a low-risk investment as your contributions have a guaranteed return. In a GIC, the investment capital earns a rate of interest over time. Usually, you are not able to transfer or withdraw your funds for a certain amount of time and have lower returns than riskier investments.

Individual Stock

Individual stocks are shares in a business or company. This gives investors part ownership in a company. These investments are much riskier since the value of shares can go up or down. Shares in larger companies are typically safer, but smaller companies may have more growth. If you decide in investing in this option, make sure to research or seek advice from professionals first.

Bonds

While it can be beneficial for the specific tax year, missing the RRSP contribution deadline is not always a bad thing. Any unused contribution room carries onto the following tax year. Making the deadline allows you to get your tax return in a couple of months rather than the next year. However, depending on your income, some professionals actually advise not making a contribution.

REITs and ETFs

REITs stand for real estate investment trusts. REITs are real estate properties that are publicly traded. These properties offer returns for rental but are also risky investments. This type of investment is not recommended for those that are short on time. These investments require thorough research and can yield high returns if done properly. If the RRSP deadline is approaching, this may not be the best option.

ETFs stand for the assembling of stocks and bonds. ETFs are similar to mutual funds but are actively traded on the Canadian Securities Exchange. Compared to mutual funds, the investment management fee is usually lower.

What Happens if I Miss the RRSP Deadline?

While it can be beneficial for the specific tax year, missing the RRSP contribution deadline is not always a bad thing. Any unused contribution room is carried onto the following tax year. Making the deadline allows you to get your tax return in a couple months rather than the next year. However, depending on your income, some professionals actually advise not making a contribution.

If your retirement income is similar to your current income, the tax savings may not be worth it. There are also plenty of other retirement savings plans such as TFSAs that do not have income tax when withdrawn. While the RRSP contribution deadline is important, some may find that skipping a year is not so bad.

When Can I Start Contributing to 2021 RRSP?

You are able to start contributing to your 2021 RRSP after the deadline for the last tax year ends. For the 2020 tax year, the deadline was March 1, 2021. This means you are able to start to contribute to your RRSP for the 2021 tax year after that date. Anything contributed between March 1, 2021, and March 2, 2022 counts as your RRSP Contribution for the 2021 tax year.

Sometimes people prefer waiting until the 60 days after the year ends to determine their RRSP contributions. This can help them get a better idea of their income and tax liabilities.

During these 60 days, you can decide whether or not a contribution is worth the tax refund or investment for the year.

When is the Last Day to Contribute to my RRSP?

The last day to contribute to your RRSP for the tax year is always 60 days after the last day of the year. Since 2022 is a leap year, the deadline to make an RRSP contribution for the 2021 tax year is March 2, 2022. This gives you all of January and February to decide how many retirement contributions you want to make for the year. If you do wait until the last minute, you have until midnight of the 2nd.

The last final day to contribute to your RRSP is December 31st of the year you turn 71. This is the ultimate deadline for an RRSP. After this day, you will need to either withdraw your personal savings, transfer the funds to a different savings account, or use them to purchase an annuity.

How to Take Advantage of RRSP Contribution Deadline

An RRSP is a type of registered savings account that can allow you to grow your money without paying current income taxes. To make the most of your RRSP, you want to make the most growth of your funds with the greatest amount of tax deductions. The contributions you make to your RRSP take away from your current taxable income. This allows you to pay less income tax for the current year.

Since you are likely in a higher tax bracket while working right now, the income tax when you withdraw the funds will likely be lower. To take advantage of the contribution deadline, we suggest waiting until 60 days after the year ends. You can determine how much tax deductions you will need compared to your contribution limits for the year.

If you find that your income for this tax year is low, it may be a good idea to skip out on contributing for the year. The tax deductions may not be worth the income tax when you make post-retirement withdrawals. You can also save your contribution room for when you have a higher income.

How Much can I put in my RRSP 2021?

While the RRSP deadline is important in making the most of your RRSPs, the contribution limit is also important. While there is no minimum amount for an RRSP, the limit set by the CRA is important to note.

If you overcontribute, there are consequences including penalty fees or decreased contribution room.

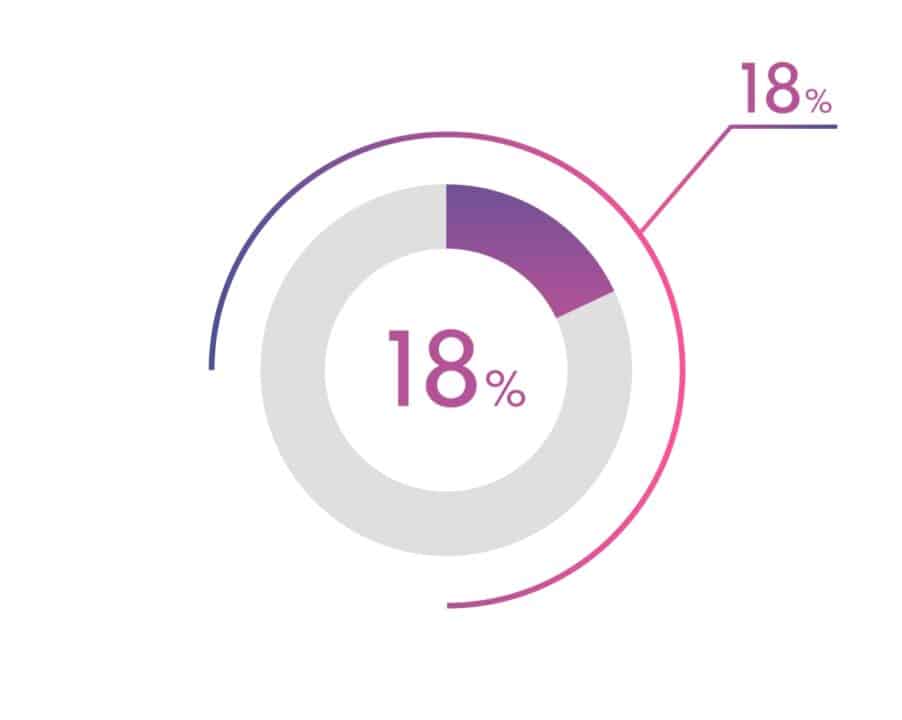

The contribution limit for RRSPs is set by the Canada Revenue Agency every year. Typically the limit is set around 18% of your earned income from the last year. There is also a government maximum besides the personal limit (check out the government-run CCP). The government maximum is set depending on the tax year and deducts your pension adjustment. Since everyone has their own personal contribution limit, we suggest checking on your CRA account.

The Bottom Line

While many people say that waiting until the last minute is not a great idea. For an RRSP, sometimes this is the best way to take advantage of the tax savings. You are able to determine the personal income and deductions you need for the tax year. The RRSP contribution limit is either March 1 or March 2 of each year.

The deadline may seem like a pressing matter, but depending on your income, you may find that skipping a year or two may not be a bad idea. To help you make the most of your retirement savings funds, make sure to meet the deadlines and stay under the contribution limits.